(Bloomberg) — Outcomes from Apple Inc. And Amazon.com Inc after Thursday’s shut is the following large hurdle to a tech-backed market rally, and it may be troublesome to articulate.

Most Learn from Bloomberg

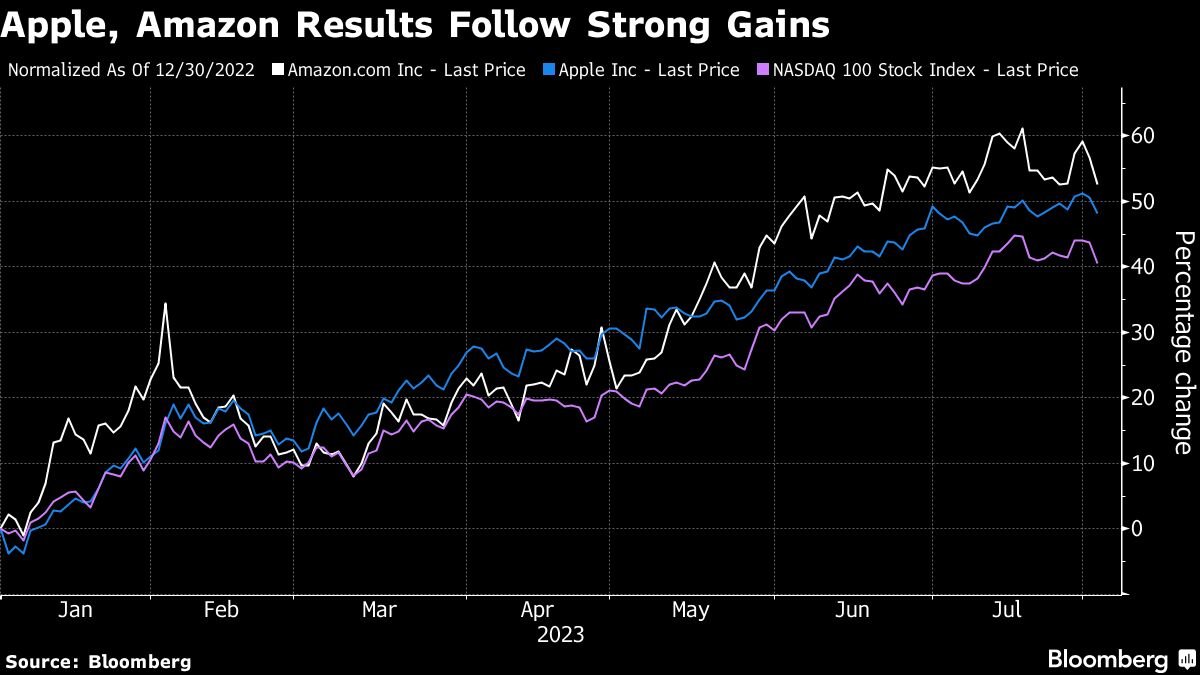

Each shares have been essential to the S&P 500’s progress this yr, luring buyers in with their comparatively everlasting income streams and market dominance. However whether or not they can ramp up positive aspects is questionable, on condition that they commerce at large multiples, face headwinds of their core companies, and have restricted direct publicity to AI — the principle driver behind this yr’s soar.

“At these valuations, both multiples want to come back down, or earnings have to rebound in a really sturdy approach, which could be troublesome on condition that a lot of the joy in AI has been priced in,” mentioned Erin Tunkel, senior US fairness analyst at BCA Analysis. . . “However that is nonetheless extra of a buzzword than one thing that strikes the needle by way of progress.”

Rate of interest-sensitive expertise shares took a success on Wednesday after Treasury yields rose within the wake of Fitch’s downgrade of US sovereign debt. A technology-fueled rally has added greater than $6 trillion in worth to the S&P 500 this yr, however the sector has struggled to rally after coming inside 5% of the Nasdaq 100’s all-time excessive final month, regardless of higher than anticipated. Experiences from Alphabet Inc. and Meta Platforms Inc.

Apple, whose 48% acquire in 2023 made it the one firm valued at greater than $3 trillion, will probably be particularly essential if the rally is to get again on monitor. The inventory accounts for roughly 8% of the S&P 500, which provides it an outsized affect over the index.

The iPhone maker is anticipated to report a 1.7% decline in income in its fiscal third quarter, which might be its third consecutive annual contraction. It additionally faces hazard from a weak smartphone market in China, considered one of its largest, whereas tepid income forecasts from Qualcomm Inc. On Wednesday, demand for cell units weakened. Nevertheless, Apple trades at almost 30 occasions estimated earnings, above its long-term common and at a premium in comparison with the general market.

“Apple looks like a steady story, not one that will experience out progress, and I do not know what it might do for buyers jazz extra given the run it is had,” mentioned David Klink, senior fairness analyst at Huntington Personal Financial institution. . “They give the impression of being costly, and presumably everybody who desires to personal them already does, so you actually should surprise what you possibly can do to get a pop.”

After rising 53% in 2023, Amazon trades at round 40 occasions estimated earnings. Whereas that is under its long-term common, the principle driver of the corporate’s profitability comes from its Amazon Internet Providers cloud enterprise. In a potential warning signal, Microsoft final week warned of a seamless slowdown in its cloud computing enterprise.

“Outcomes from Microsoft have been good, however even first rate outcomes will not be obtained effectively with Amazon,” Klink mentioned. “It’s nonetheless the market chief within the cloud house, and if it additionally exhibits issues are slowing down, buyers are most likely getting forward of themselves.”

Technical chart for at this time

The Nasdaq-100 volatility index launched by the Central Financial institution of Oman rose 12.5% on Wednesday, its largest single-day proportion acquire in almost a yr. The sudden spike in volatility got here because the Nasdaq 100 sank 2.2% right into a broad decline.

Prime tech tales

-

Qualcomm Inc. declined. , the most important maker of smartphone processors, fell 8.2% in late buying and selling after it delivered a tepid gross sales forecast for the present quarter, indicating that demand for cell units stays weak.

-

Shares of PayPal Holdings Inc. fell. After the funds big mentioned a key measure of revenue shrank within the second quarter as the corporate needed to put aside more cash to cowl unhealthy loans it made to retailers.

-

Altice USA has changed Yossi Benchetrit as head of procurement as an investigation linked to suspected fraud in European peer Altice Europe NV widens.

-

Lions Gate Leisure Corp. is near a deal to purchase the EOne movie and tv studio from toymaker Hasbro Inc. For just below $400 million, in line with individuals accustomed to the matter.

-

Tesla is providing purchasing vouchers value 3,000 yuan ($420) to new clients in Shanghai, at the side of an area authorities incentive program geared toward boosting consumption and the flagging economic system.

-

Traders continued to pile into some Korean shares seen as linked to superconductors amid claims of a breakthrough within the expertise, even because the change warned of speculative bets and unfair buying and selling.

Earnings due Thursday

-

earlier than being put available on the market

-

compact

-

Trimble

-

black knight

-

Cognex

-

arrow electronics

-

Wix.com

-

Belden

-

You see

-

ACI worldwide

-

solarwinds

-

Comscope

-

B.C.E.

-

tag

-

Expedia

-

-

postal market

-

apple

-

Amazon

-

reservation

-

Airbnb

-

fortinet

-

chip

-

Motorola options

-

Atlassian

-

Cloud Aptitude

-

GoPro

-

Epam Programs

-

GoDaddy

-

Open the textual content

-

dropbox

-

Dolby Labs

-

common display

-

backstage

-

Appian

-

entangled

-

single cable

-

howling

-

roadblock

-

— with help from Subrat Patnaik and Paul Jarvis.

Most Learn from Bloomberg Businessweek

© 2023 Bloomberg LP