-

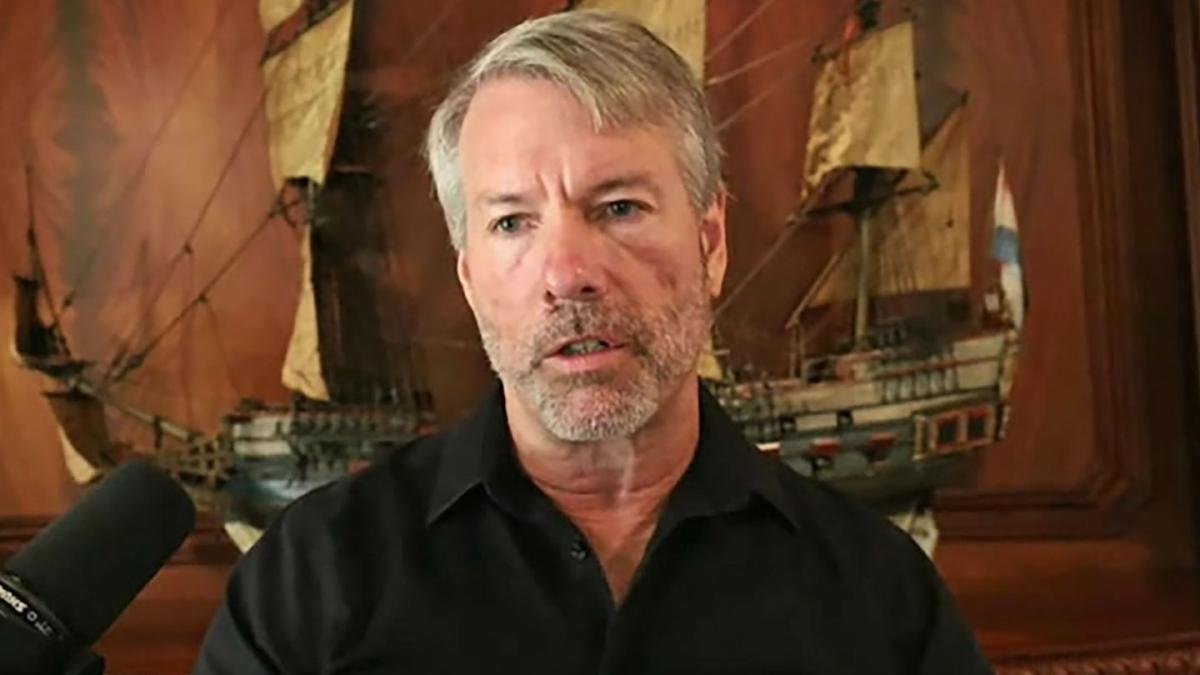

Even when a spot bitcoin trade fund (ETF) is accepted, Michael Saylor stated MicroStrategy would stay the most suitable choice for buyers seeking to achieve publicity to bitcoin.

-

He stated ETFs would carry billions of {dollars} in investments to the market, which might profit corporations like MicroStrategy, which has vital publicity to cryptocurrency.

MicroStrategy (MSTR) Chairman Michael Saylor stated his software program firm will proceed to be the go-to firm for buyers to realize publicity to bitcoin (BTC) with out shopping for it outright, even when a bitcoin spot ETF (ETF) is launched. .

If regulators approve one of many 9 purposes presently open with the Securities and Change Fee (SEC), Saylor stated in an interview with Bloomberg Tv on Wednesday, the spot ETF would pour billions of {dollars} into investments into the bitcoin market. This could assist corporations like MicroStrategy, which maintains its steadiness sheet huge Added Bitcoin quantity.

He likened the software program firm’s inventory to a quick automotive that buyers may use to extend their publicity to bitcoin, whereas an accepted spot ETF would supply the gasoline the market must hold costs from rising. “We’re that sports activities automotive. The ETF web site goes to be the VLCC,” he stated. “We think about it actually useful for your complete ecosystem.”

Shares like MicroStrategy and crypto miners are intently linked to the worth of their digital belongings on their steadiness sheets. Traders have traditionally used these shares to realize publicity to digital belongings with out shopping for them straight from a cryptocurrency trade.

MicroStrategy, a well-liked bitcoin whale, owns about $4.5 billion in bitcoin after shopping for one other $341 million within the second quarter. like that announce that he might promote as much as $750 million in shares to purchase extra bitcoin, amongst different issues.

Since adopting its bitcoin technique, which is to shift all of its income from its underlying software program intelligence enterprise into bitcoin, the corporate has returned 254%, outperforming the cryptocurrency, which has soared 145% since then, in response to a analysis report from TD Coin.

MicroStrategy shares are up about 170% this yr, whereas bitcoin costs are up greater than 70%.

Learn extra: Michael Saylor lost a lot in Dot-Com Bubble and Bitcoin Crash. Now he aims to bounce back